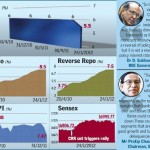

It’s definitely good news for people who have car loan and home loans since the rate of payment is to come down. This is due to the action done by Reserve Bank of India where it slashed cash reserve ratio by 25 basis point to 4.50 %. For the knowledge of everyone, the CRR is […]

Continue Reading...